Cryptocurrencies

The future of currency, contracts and trust

When you go to buy something, you'll be purchasing your product with either cash or a credit card. The money behind these mediums are dubbed "FIAT currencies". FIAT currencies have no intrinsic value[1] but has value because someone says it does (usually a government) and because people trust in the currency.

The US moved away from linking USD to gold in the 1970s and can now create USD on a whim. Convenient for the US and the USD, arguably the "global currency". The world is powered by a currency run on trust, that is only valuable whilst people still believe in it.

Crypto is short for cryptography, which is the process of scrambling and unscrambling data so interceptors can't see hidden information. Currency for money, obviously, so that's how we get "Crypto Currency".

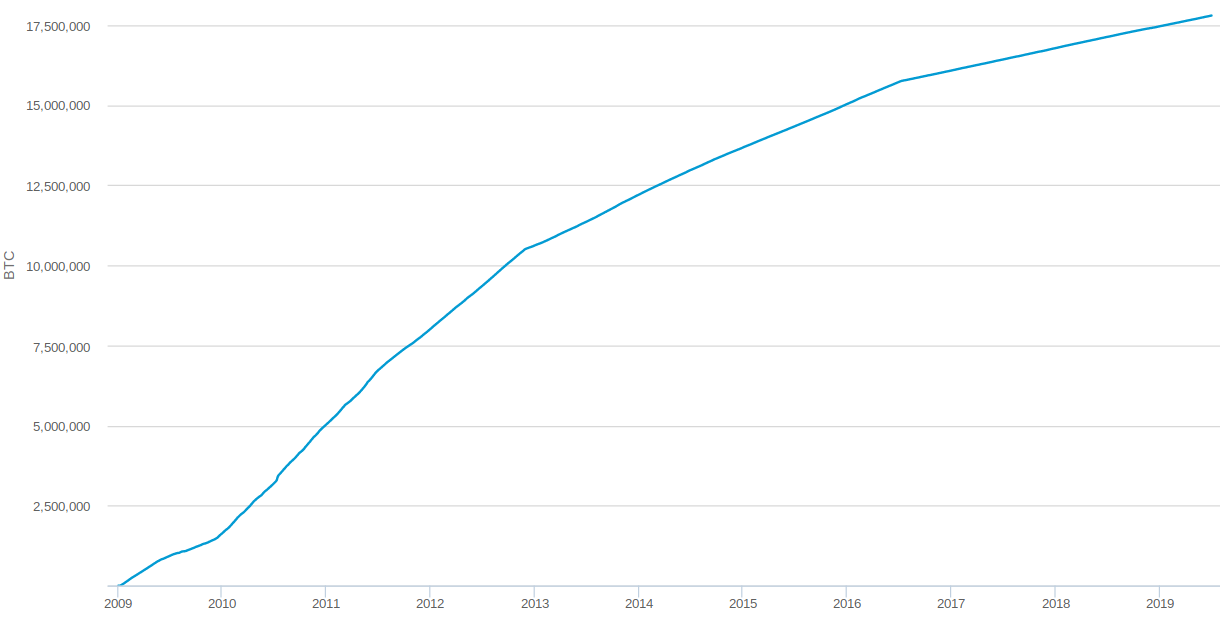

Cryptocurrencies retain the idea that money should be backed by something tangible so that value becomes intrinsic again rather than trust based. Computers mine "gold" (currency) by running complex calculations to answer difficult (but meaningless) math questions. Answering the question correctly wins you gold (currency). These math questions are released on a set schedule to tackle inflation. This schedule tapers off to the point where there are no more math questions and the amount of currency reaches its maximum.

Mining (or answering the tough math questions) is referred to as "proof of work" or PoW. PoW is now trumped by a bleeding edge idea called "proof of stake" or PoS, which we'll return to. PoW is costly as the bigger and beefier your computer is, the more power it uses. However, the more powerful your computer, the better your chance is of beating everyone else to answer the question. Issue is, there are millions of virtual miners buying in for their chance to strike some gold. Millions of beefy computers mining = a lot of power consumption[2]. It's estimated that crypto uses as much power as Australia does[3], the home of 25 million.

Blockchains?

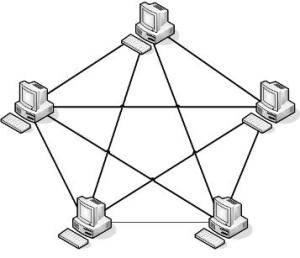

A block in this context is a computer that hosts the spreadsheet of the details of every transaction of a cryptocurrencies past. A block chain is a network of computers that all host the same document, update each other and check that everyone's on the same page. If a block tries to convince everyone that they're owed $1000, the other blocks will figure out what the majority says and will decide that the block is wrong and will ignore it. Blocks are in the order of millions, all across the globe. If a country decides to overtake all the blocks they own, they will not reach a majority and will be ignored. It is for this reason that the blockchain can be trusted. Overtaking 51% of blocks is simply infeasible.

For the same reason, the blockchain can't be taken offline. If a few blocks are taken out, the rest are still there, with the same document. No harm is done. Cryptocurrencies are gaining traction because there is no one governing body behind it nor is it possible for there to be one either. Cryptocurrencies aren't "made up" or FIAT currencies, because they are backed behind these computer calculations.

Bitcoin?

Each "crypto currency" takes their own spin on the same idea of the blockchain. There are thousands of spin off cryptocurrencies, but the current largest is bitcoin. Bitcoin was one of the first cryptos, and its age is showing. It takes an hour on average to make a transaction over bitcoin, which is a step in the right direction from banks which usually take three business days. Transaction fees hover around $2.

Ethereum?

Is the new kid on the block(chain). Transaction fees are fractions of cents and transactions take around 3 minutes[4]. Moving to proof of stake[5], saving power and speeding up transactions. If bitcoin were a calculator, Ethereum would be a smart phone[6]. The smartphone can still run a calculator but can do far more. Ethereum has this system called "smart contracts" which essentially cut out the middlemen such as lawyers when going through processes such as marriage or buying real estate.

Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly. - Vitalik Buterin (Ethereum's creator)

Ethereum has the most developer support of all cryptocurrencies, and it has the largest support from companies too with the likes of AMD, J.P Morgan, Intel and Microsoft[7]. Finally, of the top 400 cryptos, 324 are based off Ethereum (remember, Ethereum is a programming language as much as it's a currency).

Wrap up

Cryptos are decentralised, disconnected from any governing body and have no regional restrictions. Anyone can make an account (wallet) and view the code behind cryptos. Cryptos are anonymous and usually make transactions faster than banks (particularly internationally). You'll be seeing them a lot more in the future (especially keep your eye on Ethereum)!